With five months to go before the presidential election, the latest inflation data tell the same basic story of the last two years: Disinflation is continuing, yet overall prices since the pandemic remain burdensome for too many working Americans. According to the latest Federal Reserve household survey, 19 percent of adults say that price levels have made their financial situation “much worse,” while two-thirds of households earning less than $100,000 per year have reported some degree of inflation-driven financial stress.

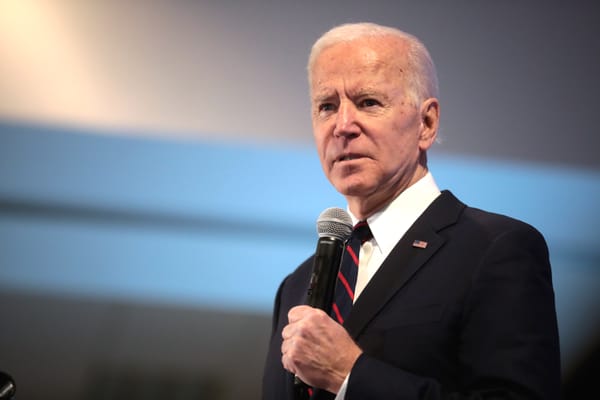

“High prices have cast a shadow over President Biden’s ambitious economic agenda.”

For now, the Fed’s answer is to hold steady on interest rates, which stand at a 20-year high of 5.25 percent to 5.5 percent. The premise is that, with inflation hovering around 3.4 percent, the “soft landing” from the pandemic’s economic chaos and the so-called revenge spending that followed are still very much in progress, even if we are past the worst of the supply-chain shocks of the Covid era. But this scenario has only reinforced the bind facing Democrats determined to forge a durable post-neoliberal framework. Due to the inadequate, even counterproductive, strategies to fight inflation, stubbornly high prices have cast a shadow over President Biden’s ambitious economic agenda.